The year 2008 is now drawing to a close. It should remain burned in my memory as a year of extremes. A year of extreme volatility, an unprecedented series of depreciation in the banking sector and a unique spiral of loss in property shares and property itself is also the raw materials like oil showed a variation of $ 40 to 145 $. Future developments may appear only as judged normal. 2008 was insane!

The problems are becoming increasingly apparent clear and visible through adjustments to the gains in the corporate balance sheets. Even very strong established companies like Toyota must now operating losses (about 1.2 billion for 2008-2009) is on the cards. This is unique in the history of this company, which already exists since 1940. The exchange process but increasingly bad news in a reinterpretation of the formula: the worse the news, the better it can really only be.

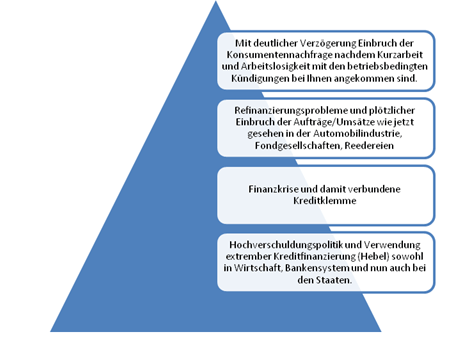

The problem of this crisis is that it is not a normal recession, but based on an extreme debt, especially the U.S., whose scope ranges from deflation, inflation and U.S. dollar-collapse and an unprecedented Credit crunch. The experience of Japan and from the Great Depression of the 30 also shows that an accompanying banking crisis a recession, both in intensity and in the time period expands significantly. The hope of the stock market with a lead of 9 months of the end of the recession may already expected to play now, very quickly disappear. The pyramid problem is to describe, in my interpretation in such a simple form:

you thus describes a fundamental point of view, which shows that the overall problem can be solved in the base only with the finding of answers and actions. Everything else will probably relieve the pain short term, the pyramid, but still can not rely on stable foundations. The problem solution is therefore in my view, in any case to look at the consumer, but should be in a Delevarage (deceleration of loan financing) and the temporary state intervention into the banking system to resolve the credit crunch be solved by loans, by forcibly administered. If the state guarantees for banks, so he should be able to ensure its basic task and force. Only then it means-sized to large corporations will again be possible to ensure the flow and internal financing of projects by refinancing loans as before. Only at the end may involve economic programs, that appear useful only in individual cases if in time to address these structural problems such as energy and education. Their success is related to but not in the short term, but aims at a sustainable solution. I believe that the West is doing so well to their economic recovery plans just to balance the need for debt relief and the maintenance of financial capacity.

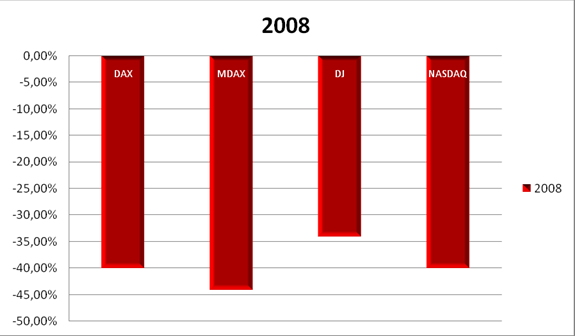

here to complete even a small graph to analyze the market trends:

forecast for 2008

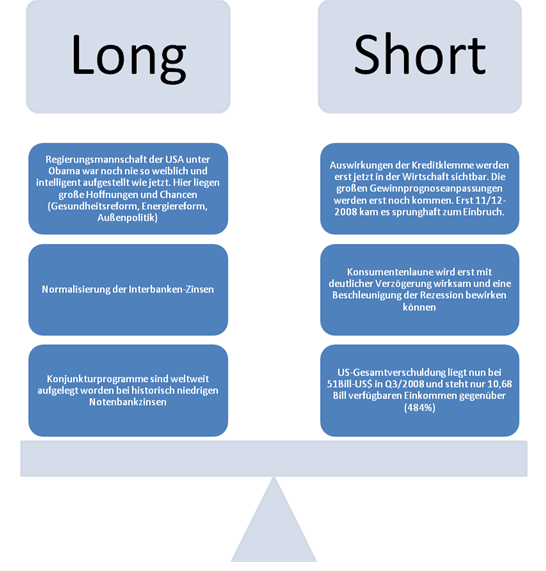

How it go now. Honestly no idea. If I make even the arguments on a scale, then I remember following a first. The balancing of the scales has to make anyway everyone for themselves. I myself tend to Q1/2009 for a short position clear, and only with tolls. real positive news in the fight against the credit crunch and the housing bubble in the U.S., it can go up again. The problem remains how long to keep foreign investors still above the U.S. $. If this tip is to stop it all and we have time the "good night song" to sing.

0 comments:

Post a Comment