My Trading Depot is now only a game depot with a few hundred € capital to try some ideas I continue. currently see no need for the investment rate increased. money management is, in these times to realize that we should stick together in these extreme volatility despite chart analysis, various stock tools, filter systems, dynamic course lists in the main, the money and one time with can use a small play money to extreme in this learning phase to learn and learn again.

The sense of market sentiment and a clear view on the current stock market situation is that what can now afford a stock market program, but only to himself I am still only index KnockOut certificates trading on the road, where high leverage without extreme spreads are possible. With fundamental analysis approaches, such as PSR, P / E or other dividend yields even get time to practically nothing, since nobody can predict the mutually reinforcing effects of the financial crisis / credit crunch. Earnings estimates are seen such as Toyota, Daimler, Commerzbank, Intel, Microsoft, within weeks only coffee grounds.

Intel had confirmed in October, its sales / earnings forecasts, just 4 weeks later to shave his own forecasts by 23%. This is either a matter of enormous mismanagement or a really dramatic global business development for Intel in November / December. Even if the stock markets still try an optimistic turn predict the dramatic developments now coming to be largely underestimated. They underestimated the same as with the financial crisis still rising stock market prices in March-June or July-August last year.

The absurdity of the German investors showed particularly in the DAX development on Friday. Here were the 0.5 million! reported newly unemployed in the U.S. in fact initially interpreted as positive by the beginning of U.S. trade because about 0.025 million fewer people have been reported as estimated. Comparison logic that has been so shaved within 30 minutes with a price movement of almost 3% in the DAX. In the U.S. we have therefore already been 2.6 million more unemployed and can still go out of airbrushed figures, as the Net Birth / Death Model reckons continue creating new jobs as estimated by suspected +53,000 new jobs in financial services. I think there is nothing more likely than these statistics.

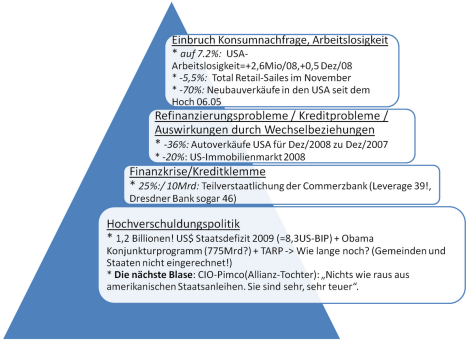

gives reference to the problem of the pyramid last blog entry is to the following problematic picture with news from the last two weeks:

As written in the current phase helps no exchange program, not a portfolio management tool, not a fund manager to reduce its risks. Capital hold conservative in safe investments and max on the exchange. Play seems to be the order of the day. I personally invest impossible because predictions seem to be really just silly or even useless statements. The Guild of capital market experts and analysts even has it disqualified the last few months almost full. This was not only still valid statement. I see this as really only the developments after running sheep.

My model portfolio, I will "fill" for reasons of learning continues even with the small amounts. At least a learning effect will it have had in the end.

0 comments:

Post a Comment