All the major indexes have laid an impressive rally since 09.03.2009:

- DAX: +25%

- TecDAX: +33%

- Dow-Jones: +25%

- Nasdaq: +28%

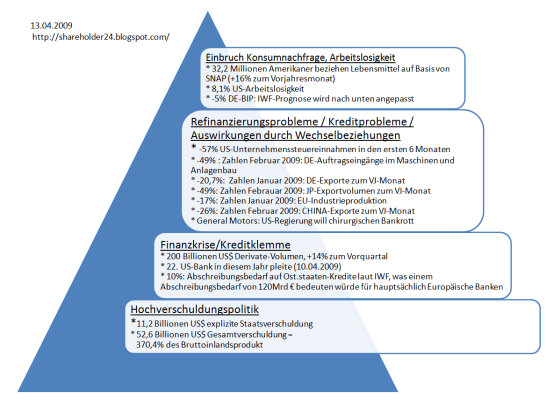

My basic ideas of pyramid problem still applies. An update this pyramid at the current time it clearly shows a further aggravation, as an improvement. It is still not solved a fundamental problem addressed fundamentally. On the contrary, the credit bubble is fueled by credit. The stock market rally is for me a hope to rally, which will fail under current state. Nevertheless, one should not unnecessarily close your eyes, but play this bear market rallies. 25% in 4 weeks have been an incredible and almost historical price performance. In equity markets, it was thus, as so often, to moods and aspirations, and not a reflection of past economic development. The crucial question is thus whether a real economic turnaround now is already possible.

"The monthly report from Friday for March 2009 on the U.S. Federal Budget (Monthly Treasury Statement), is a downright exploding budget deficit.

- spending shot in the first 6 months of the fiscal year 2009 +33.4% in the amount to 1.946632 trillion ,

- while the tax revenues -32.18% to 0.989834 trillion dollar slumped, according to 1.45968 trillion dollars in the first 6 months of fiscal year 2008!

- The corporate tax revenue burst of 129.5 billion dollars in the first 6 months of 2008 to only 56.2 billion U.S. dollars in the first half of fiscal year 2009 away. This raises a particularly bleak picture of the economic situation in the U.S..

- But the revenue from income tax broke off an impressive 15%, of 503.5 billion U.S. dollars in the previous year to 429.7 billion U.S. dollars! The figures show so impressive that the U.S. unemployment figures are hopelessly fined and has nothing to do with reality have. An income tax break away from -15% in 6 months and a rise in unemployment by about 3% over the same period fit for me do not mix.

- The explicit general government (cash today) public debt marked by 09/04/2009 with huge 11.169 trillion a new Record! A brutal increase in the last 6 months of 1.1459 trillion dollars! In 1975, the explicit public debt stood at 533 billion dollars, an exponential function with the U.S. national debt at its best.

- According to official data from the U.S. Federal Reserve (FED) 4 Quarter of 2008, the total debt of state (explicit), households, businesses including the financial sector in the United States enormous 52.5927 trillion dollars, or 370.4% of gross domestic product.

Source: http://wirtschaftquerschuss.blogspot.com/

0 comments:

Post a Comment