is to find time in my view, a new status. The short strategy has proven to be just right, even though I have this in the depot could not take full advantage. Respect for a technical rebound and government intervention was sometimes not without justification, as my usual KO bills would have been simply knocked out the current volatility. I have therefore always tried Intraday waves to ride. The diurnal variations were present within the major indices so enormous that with a small lever was already earning very much money. It had a self only a few basic properties of the current market, be aware of. The fear and greed gave each other at ever shorter intervals, the hand. The movements were there some with +5> 5% so strong that it was reasonable for money management almost inevitably stopped out. This itself is not bad, only one had the courage to always test positions in the market place and also be prepared to lose several positions and then test them at a wave then to ride tight trailing stops. Completely impossible for me was the overnight trading, as reported in the night, new messages have already been priced in already pre-market with the opening of the pre-market trading so much that had already been recorded heavy losses. This is true especially since I have used increasingly powerful levers to take advantage of the very short-term fluctuations sufficiently.

As always the latest model portfolio is available at:

model portfolio Shareholder R / 2

With the result I am very happy because I've been avoiding me for insisting on a position, but I always waited for the position in the market and only this position have been following.

current stock market

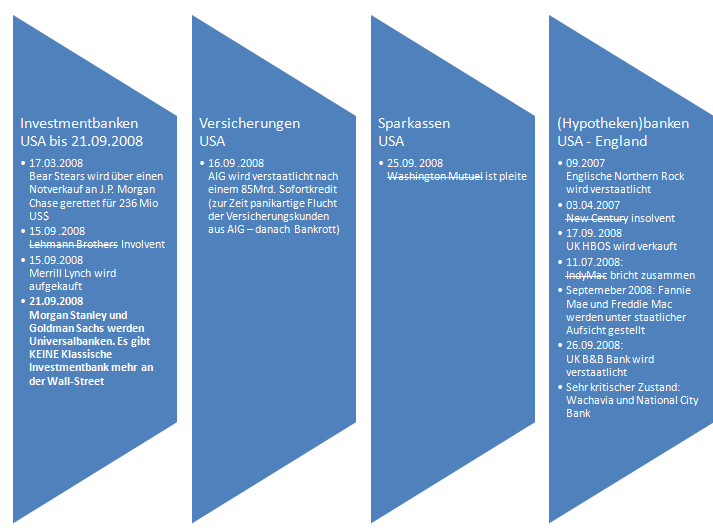

The current situation is unique in the history of global finance. There is currently a domino after another, the distances between the tip of the stones is always smaller.

Here is a very crude simple summary of recent events:

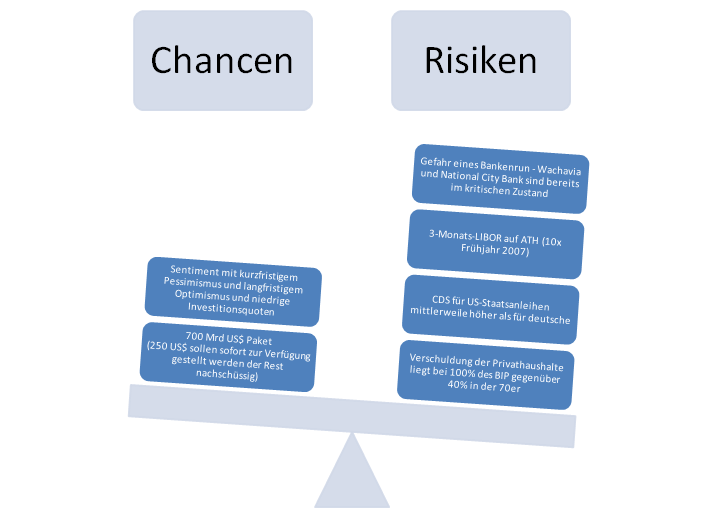

The latest Verzweifelungstat the U.S. Treasury (which has been approved by Congress but not yet up as of today) provides a collecting society of 700 billion U.S. $ and is lazy loans from the balance sheets of troubled U.S. banks take. Which is something often overlooked is that even with complete Use of the volume by the banks, in the end only 27 billion U.S. $ to the actual strengthening of the equity ratio remains. This is to leverage the debt of 25, ie the ratio of debt to equity. Almost everything was so on it to repay debt. The current operating deleveraging of the banks here will contribute to further aggravation of the situation because of the economy remain increasingly implies denying loans. The spiral goes on and so on.

With the latest August numbers but have a more gloomy picture of the U.S. economy. So now, the household debt is already higher than the gross domestic product accounts, ie about 14 billion U.S. $. The dominoes Credit Cards (June 2008 were 4.03% already in default, a year earlier it was still 2.9%), auto loans, leases and, ultimately, consumer spending should jiggle considerably. In the forums and in the financial newspapers to read in part, optimism, can not initially shared by me. I think the worst is yet to be in front of us, even if it can be at least intermediate rallies in the stock market at any time.

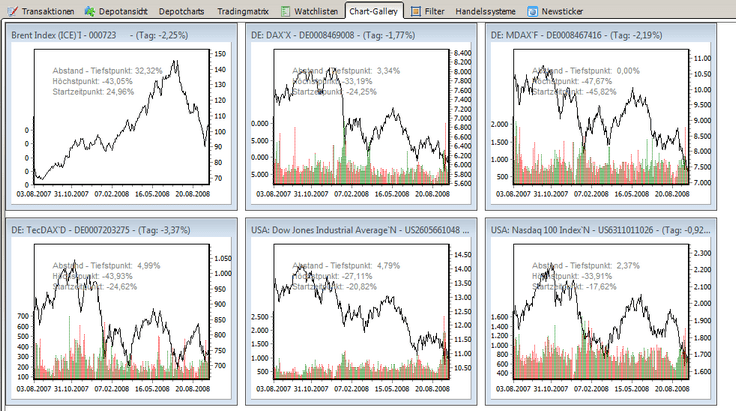

The current view of the market here is again a rough picture of what has been erased in recent months actually on the market. Dow Jones has made the price high in October 2007 from 27%, the DAX and the MDAX was already 33%% already 47th Of expected Recovery movement can not speak yet so far, as far a turning away of a global financial crisis has not yet been secured. Real economic turmoil especially by the current credit crunch may already not be excluded. Further outflows in certificates and funds, or a bank run can set the markets continue under considerable pressure. For optimism, it is again only time when signs of recovery are visible on the U.S. housing market.

The coming months will, in my opinion very uncomfortable in the real economic environment. Currently, this opinion seems not a "consensus opinion" to be what is good, because this could fulfill a prophecy by itself quickly.

Still, I expect in the next few days, a crunchy short bear market rally. I hope to be there. As ground for this rally, I see this clearly pessimistic sentiment in the market, the very low investment rates of the professionals and the "apparently" very favorable ratings of individual companies. The waste can be quickly these assessments should be known. The recent revisions to earnings estimates are 25% but also from the market priced in already. What has not been "processed" are more dominoes.

As written at the beginning, bring an open attitude the search for opportunities in the Short and the Long environment, a good basis to make money in spite of the difficult market environment, money. I dream while still a 10% I can surf the wave continuously. The gains of recent months have been very difficult and punctuated by peaks down.

0 comments:

Post a Comment