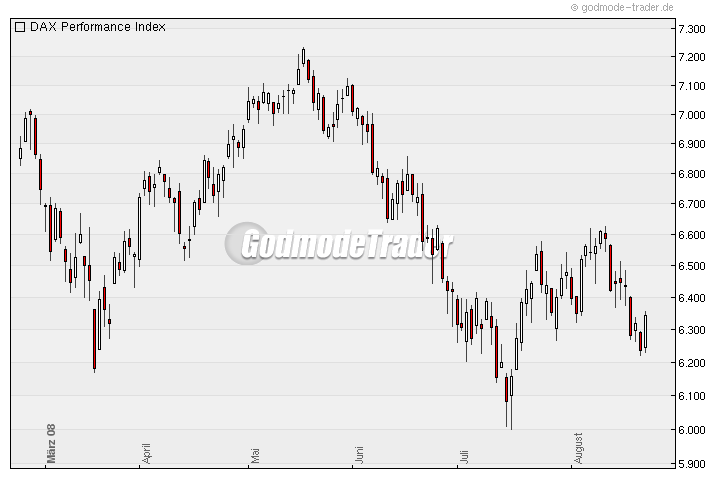

The charts speak for prices to rise further in the coming week. I'm not positioned as I want to sleep the weekend still. The losses of yesterday were today with a DAX call be compensated.

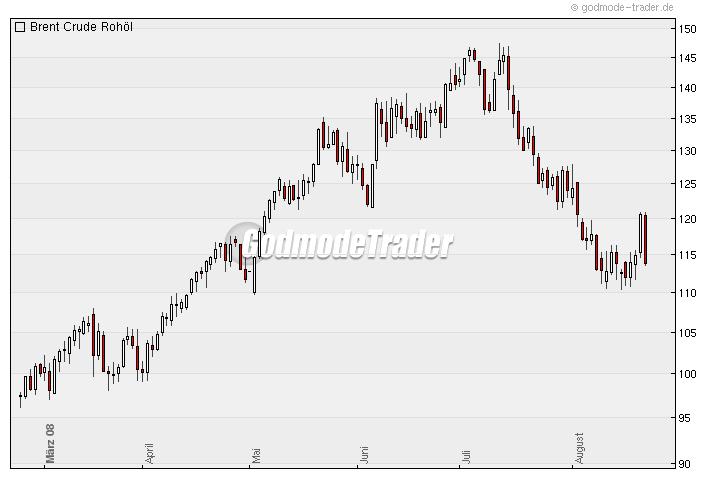

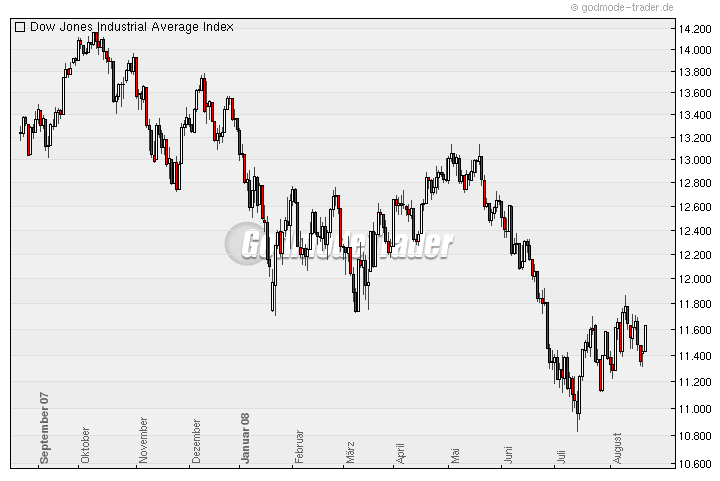

The often described the relationship between Big Oil, U.S. Dollar, Dow and DAX I can not see the time. The oil exhibits correlations to the U.S. $, of course, with the Dow, the DAX. that is the cause of price movements and movements in the Dow and news in the U.S. are $. Everything else is secondary. could

Dow and U.S. $ gross driven by news in the banking industry and economic data that describe the extent of the recession or the end of forecasts. Both types of items show so far but still a "deterioration" of the situation. At more than a chart-recovery, I can not believe so. Nevertheless, you have to keep in mind that without the new news Sentiment is oversold and the mass should be under-invested.

The immediate sale of yesterday's impressive rise shows that the commodity rally could still be over. Or is there more to it here? It is interesting here is that these impressive sales even with today's gains in U.S. indices - could happen (> DAX).

0 comments:

Post a Comment